HSAs – Your Retirement Nest Egg

If you’re familiar with Health Savings Accounts (HSAs), chances are that you’ve heard about them in the context of using them to pay for immediate healthcare costs. Did you know that HSAs can also be a great retirement savings tool? If you didn’t, you’re in the majority. Unfortunately, most people don’t know that they can use HSAs to invest in their future. In fact, the Employee Benefits Research Institute estimates that about 9% of all HSAs are being invested.

When you’re planning for retirement, you should consider how you can use an HSA to meet your financial needs once you exit the workforce. Underestimating medical costs is a common retirement planning mistake. Your healthcare needs are likely to increase with age, and the cost of healthcare grows with every passing year. For example, if you end up needing long-term care, the costs are likely to quickly add up. You need to think about how you can save enough money to meet your healthcare needs in the later years of your life.

HSAs are a valuable investment tool that provide helpful tax benefits, and there are ways you can take advantage of them to better fund your retirement and later medical care.

Are you eligible for an HSA?

To be able to have an HSA, you must be enrolled in an eligible high deductible health plan (HDHP), which is a health insurance plan that has low premiums, but high deductibles. To offset the costs of higher deductibles, HDHP participants can use HSA funds to pay for medical expenses. You can contribute to your HSA with pretax dollars, much like with a 401(k).

In 2022, the maximum contribution for individual coverage is $3,650 and $7,300 for family coverage. For 2023, the IRS increased these limits to $3,850 for individual coverage and $7,750 for family coverage. Unlike with flexible spending accounts (FSAs), unspent funds roll over each year.

You’ll need to determine if an HDHP is the right choice for your medical needs, as well as your dependents if you need to account for them. An HDHP with an HSA is a good option for people who are healthy and have predictable annual healthcare expenses. If this is your situation, you can save a lot of money from the lower premiums and tax advantages of an HSA. However, an HDHP with HSA might not be the best choice for people who are older, people who are prone to unexpected illness, or people who are less healthy.

If you determine that this is the right option for your circumstances, you can estimate a cash target for your medical expenses, then set aside additional money to invest and grow for the future.

How do you estimate how much money you should set aside to pay for your immediate healthcare expenses?

HSA funds for immediate expenses vs. future investment

Even though you might not know with full certainty what your health will look like in the coming year, there are steps you can take to understand your needs and be prepared for both anticipated and unknown costs. You will need to think about how financially comfortable you feel with paying for current medical bills, including unexpected expenses, within the entirety of your financial picture.

Here are some questions you can ask yourself to get an estimate of how much money you’ll need to cover your healthcare expenses in the coming year. After you determine this amount, you can consider investing additional funds for long-term growth.

- How much did you spend on qualified medical expenses the last year?

Qualified medical expenses include money you spent on copays, coinsurance, dental care, mental care, eye care, and prescription drugs. You should be able to log into your HSA and health insurance accounts to see how much you spent on healthcare expenses in the past year. If you want to go the extra mile and paint a more complete picture, you could look at how these expenses tracked year over year.

- How many expenses do you anticipate having in the coming year?

There are years where we might have more healthcare expenses than others. Maybe this year you had a medical procedure that you won’t have in the coming year that made you spend more than a typical year. Or maybe in the next benefits year, you know that you’ll need to have a surgery that will make you spend more money than usual. Think about if next year’s expenses will be higher, lower, or about the same to come up with an estimate of how much money you’ll need to set aside to cover your immediate out-of-pocket costs. Always keep in mind that emergencies can happen, and this estimate isn’t full proof in outlier situations.

- Can I adjust my budget to increase my HSA contributions and invest them?

Once you determine how much money you need to cover short-term expenses, you can look at the rest of your budget and determine if you can put more money into your HSA (up to the annual contribution limit) for long-term growth.

How can you invest HSA funds?

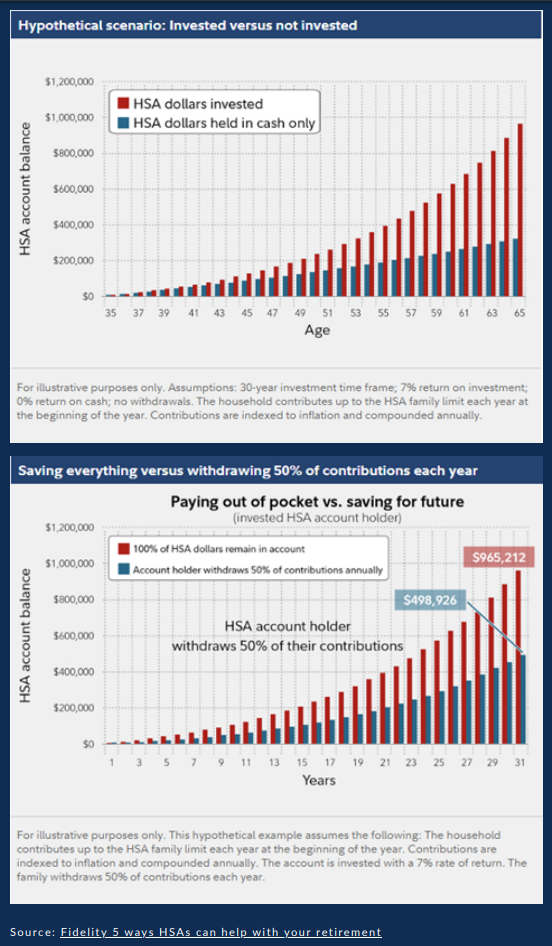

If you’re able to invest any of your HSA funds, they have the potential to grow so you have more of a financial cushion as needed over time, through when you retire. When you invest your HSA funds, they’re more likely to grow faster than if you don’t.

You’ll want to make sure that the HSA you have provides the investment options that align with your goals. Some HSA providers only allow investments with low risk and low returns, while others offer access to investments with higher risk, and higher returns. Additionally, certain HSAs only allow you to invest after you’ve contributed a minimum amount. It’s also up to you to look at the fee schedule for your HSA before contributing.

If you have an HSA through an employer sponsored health plan and it doesn’t provide you the investment options you want, you can transfer the funds to a personal HSA that’s better aligned with your needs. Be sure to shop around for a plan with low cost, high quality investment options.

Deciding how you want to invest your HSA funds depends on your goals and unique circumstances. Understand your risk tolerance and potential medical needs when mapping out your investment strategy. Always stay up to date with withdrawal rules, as these might change over time. Common investment options include:

- Stocks

- Mutual funds

- Exchange-traded funds

- Bonds

- Dividend funds

Each of these options has benefits and downsides, so if you’re an inexperienced investor or want to make an informed decision about how to invest your money, be sure to connect with a financial advisor who can help you find which options work best for your financial footprint. Your HSA investment strategy will likely resemble that of your 401(k), wherein you make riskier investments with higher rewards the further away you are from retiring, then reallocate your funds to less volatile investment options as you approach retirement.

Source: 5 ways HSAs can help with your retirement

Weigh the pros and cons of investing HSA funds

Depending on your physical health and financial picture, investing HSA funds may or may not be the right option for you. Here are some things you should consider if you’re thinking about investing your HSA funds.

Pros:

- Triple tax advantage: An HSA comes with a triple tax advantage because you don’t pay taxes on the money you contribute, on earnings, or money you take out for qualified medical expenses.

- Growth over time: If you’re maximizing contributions to other retirement accounts, an HSA is another vehicle for long-term financial growth. If you invest your HSA funds, you can reap the rewards of compound interest.

- Potential employer contribution: Similar to retirement accounts, employers will often contribute to your HSA. This is free money that you can use to invest in your future.

- More money for retirement: Healthcare is expensive, especially as we age. If you can create a greater financial buffer by investing your HSA funds, you should. Additionally, you can withdraw HSA funds and use them for nonmedical expenses after you turn 65 without paying the 20% penalty. However, you’ll have to pay taxes on this type of withdrawal.

- HSA funds move with you: Unlike a 401(k), which is tied to your employer, your HSA isn’t. Your HSA funds roll over year over year and you get to keep them if you change jobs.

Cons:

- Unexpected healthcare expenses: If you invest your HSA funds and experience a costly, unexpected medical situation, you’ll need to have the money available to pay for the expenses.

- Market volatility: The market is unpredictable, so if you plan to use your HSA in the near future, this might impact the money available for you to tap into to cover medical costs.

- Fees: Clarify the fees associated with investing your HSA, as some HSAs come with high fees, while others have low fees.

- Only available with HDHPs: HDHPs aren’t for everyone, especially people who need a lot of medical care.

- Recordkeeping: If you use HSA funds for medical expenses, you need to keep all receipts to prove that withdrawals were used to pay for qualified expenses in case the IRS audits you. This may be difficult to do over a prolonged period of time.

Don’t forget to choose a beneficiary

Like with any investments you make, it’s important for you to choose a beneficiary who will receive account funds should you pass away. Though this isn’t the easiest thing to think about, the last thing you want is your loved ones to get into disagreements in your absence over who gets what. You also need to revisit your designations from time to time in case you experience life changes that impact your decisions. You want your beneficiary designation to be a reflection of your wishes.

Talk to a trusted expert

It’s clear that you’ll have to weigh a lot of variables if you want to ensure you’re maximizing your assets. If an HSA makes sense for you, it can also serve as a great vehicle for your retirement savings. Developing a practical and effective retirement strategy requires foresight and careful planning.

Connect with our Retirement team today to learn more about how you can invest your HSA funds and execute a retirement savings plan to safeguard your future.

This material has been prepared for informational purposes only. BRP Group, Inc. and its affiliates, do not provide tax, legal or accounting advice. Please consult with your own tax, legal or accounting professionals before engaging in any transaction.

Securities offered through Kestra Investment Services, Inc. (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS. AHT Retirement Services is not affiliated with Kestra IS or Kestra AS. Neither Kestra IS or its affiliates provide legal or tax advice and are not Certified Public Accounting firms California license #0658748 *not licensed in the states of NY & IL. https://bit.ly/KF-Disclosures

Download the Article

HSAs – Your Retirement Nest Egg