NOT EVERY TRIP IS THE SAME, SO WHY SHOULD YOUR TRAVEL INSURANCE BE?

Purchasing travel insurance for your next trip is an essential step in protecting you against unexpected events like your trip being canceled, interruptions due to sickness or injuries while abroad, flight delays and much more. We’ve partnered with battleface to offer customizable travel insurance for your next trip by selecting only the benefits you need.

CLIENTS FIRST

With the purchase of battleface’s Discovery Plan, you will gain access to our 24/7 emergency and travel assistance program via our very own Robin Assist team to ensure safety while traveling.

KNOWLEDGE FIRST

In the ever-changing insurance marketplace, AHT works to find the best partners to provide our bespoke travel insurance. Our partner, battleface, allows you to customize your ideal plan – only selecting benefits you will need. Traveling international? Select battleface’s travel medical package and opt out of the benefits you don’t need.

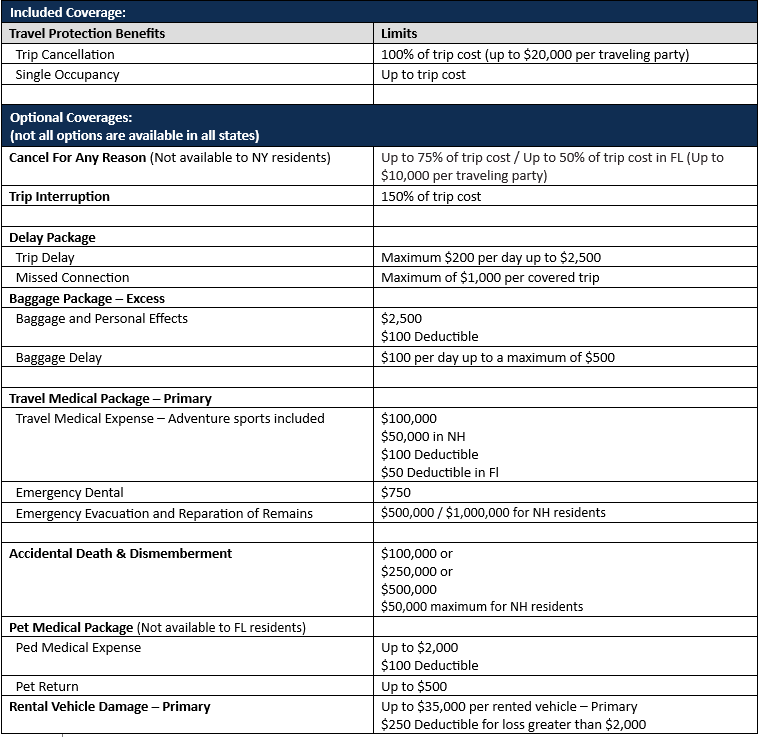

BATTLEFACE DISCOVERY BENEFITS INCLUDE:

24/7 Emergency & Travel Assistance

Available Coverage for Pre-Existing Medical Conditions*

Available Cancel For Any Reason Coverage*

Coverage for Adventure Activities

PLAN ON TRAVELING MORE THAN TWICE A YEAR?

battleface offers comprehensive coverage for 365 days made for those who travel spontaneously, or take more than two trips per year. Click here to get your quote.

*Must purchase the plan within 15 days of initial trip deposit, and insure entire trip cost, to qualify for waiver of Pre-Existing Medical Conditions exclusion. Cancel For Any Reason Coverage must be purchased within 15 days of initial trip deposit and more than 10 days before departure date, must insure the full trip cost, and cancel before 48 hours of scheduled departure.

AHT LLC principal office is located at 20 South King St, Leesburg, VA 20175, National Producer number 663637, VA license number 110239/CA license number 0658748/FL license number L025434.

Important Note: battleface Travel Insurance plans are underwritten by Spinnaker Insurance Company (an IL Corporation, NAIC# 24376), with administrative office at One Pluckemin Way, Suite 102, Bedminster, NJ 07921. Plans are offered and administered by battleface Insurance Services LLC,45 East Lincoln Street, Columbus, OH 43215, National Producer Number 18731960 (FL License number L107363/CA License number 0M75381). Travel retailers offering this plan may not be licensed insurance producers and cannot answer technical questions about the terms, benefits exclusions, and conditions of this insurance or evaluate the adequacy of your existing insurance. Your travel retailer may be compensated for the purchase of a plan and may provide general information about the plans offered, including a description of the coverage and price. The purchase of this plan is not required in order to purchase other travel products or services offered by your travel retailer. This is a brief description of the coverage provided under policy series RIG-1000, the Policy will contain reductions, limitations, exclusions and termination provisions. Please refer to the policy for complete details. If there are conflicts between the information on this site and the Policy, the Policy will govern in all cases. Not all products or coverages may be available in all jurisdictions. Non-insurance assistance services are provided by Robin Assist LLC (in CA: battleface Insurance Services dba Robin Assist).

CIGNA GLOBAL HEALTH BENEFITS INCLUDE:

International medical insurance is crucial for individuals who travel or live abroad. Let’s delve into why it’s essential:

Coverage Beyond Borders

-

- Local Health Plans Limitations: Most health insurance plans are designed to cover medical expenses within the country of residence. When you travel internationally, your existing health coverage may not apply effectively.

- Global Protection: International medical insurance ensures that you have access to quality healthcare wherever you are. It covers emergency medical expenses, including hospitalization, outpatient care, and wellness services.

Pre-existing Conditions:

-

- Coverage for Pre-existing Conditions: Some international insurance plans offer coverage for pre-existing medical conditions. This is especially important for travelers with chronic health conditions.

- Check the Details: Be sure to understand the terms related to pre-existing conditions in your chosen plan.

Emergency Situations:

-

- Unexpected Illness or Injury: Imagine breaking your leg while on vacation abroad. International health insurance provides reimbursement for emergency medical expenses, including medical evacuations.

- Peace of Mind: Knowing you’re protected in case of a medical emergency allows you to focus on enjoying your travels without worry.

Visa Requirements:

-

- Visa Necessity: Many countries require proof of adequate health coverage for visa issuance. International medical insurance fulfills this requirement.

- Smooth Visa Process: Having the right insurance can expedite your visa application process.

Financial Protection:

-

- Costly Medical Expenses: Healthcare costs can be exorbitant in some countries. International insurance provides financial protection against unexpected medical bills.

- Emergency Evacuation: If you need to be evacuated to your home country for medical reasons, the insurance covers these expenses.

Flexible Plans:

-

- Customizable Options: Choose a plan that fits your needs. Options include levels of coverage, additional extras, and excesses.

- 24/7 Support: International insurers offer round-the-clock support from in-house clinicians and multilingual case managers.