The Early Bird Gets the… Money

6 Reasons to Start Saving and Investing for Retirement EarlyIt might seem like retirement is far away and that you have a lot of time to prepare for it. This is a common excuse that people make when they put off saving for retirement, but the reality is that when it comes to retirement planning, it’s never too early to start.

There are many benefits to investing in retirement as soon as you can, preferably as soon as you begin working. Building up the funds you’ll need for the lifestyle you want when you retire becomes more difficult the more that you wait. Though you might not make as much money when you’re younger as when you advance in your career, you’ll have more time. As you’ll learn, there are many reasons why time is your best friend when you’re building up your retirement savings.

Our Top 6 Reasons Include:

1. Compound interest

Compound interest is likely the greatest benefit of investing early in retirement. Though there’s no guaranteed set rate of return, when you start saving for retirement earlier, you’ll end up with more money with a smaller capital investment than if you wait until later in your career to start. Compound interest is the process of a sum of money growing significantly due to interest building upon itself over time.

For example, if you invest in $1000 in an account that grows five percent every year, you’ll have $1050 at the end of the year. The following year, you’ll see a return of five percent on $1050 dollars which would amount to $1102.50 after two years.

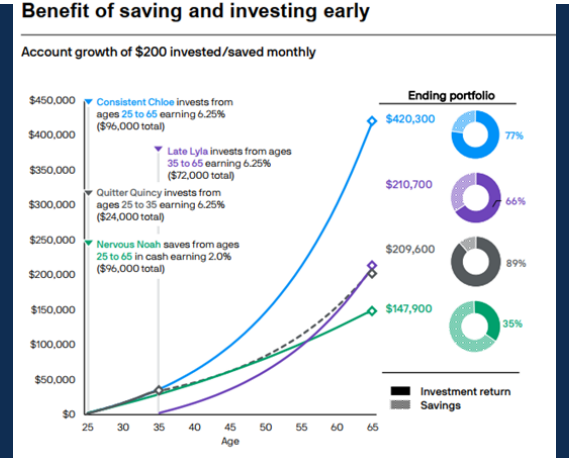

Here is a visual representation on how consistently investing in a retirement portfolio early on makes a big difference over time.

The above example is for illustrative purposes only and not indicative of any investment. Source: J.P. Morgan Asset Management, Long-Term Capital Market Assumptions. Compounding is the increasing value of assets due to investment return earned on both principal and prior investment gains.

2. Financial flexibility

Putting off saving for retirement later in your career means that you’ll have to set aside a lot more money from your paycheck to have enough money to retire versus if you start in your 20’s. Having to set aside $100 per month versus $1000 can make a big difference in how you manage your day-to-day expenses. And we can’t reiterate the value of compound interest enough here.

Have access to an employer-sponsored retirement plan? Take advantage of it as soon as you can. Most employers will match contributions up to a certain percentage, so if you’re not putting money into the plan, it’s like you’re throwing away free money toward your retirement.

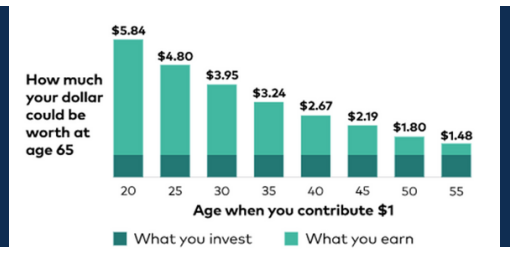

Source: Vanguard “When should you start saving for retirement?

3. Access to higher risk, higher reward investments

Early investment grants you access to a more diversified portfolio. You have the time to tap into higher risk, higher reward investments. If you start saving in your 30’s or 40’s, you have to stick to safer investments because it’s not a risk that you can afford the closer you are to retirement age. Being able to tap into investment opportunities with the potential of a great return is like to give you a larger financial cushion when you retire.

Investing in your retirement early on also increases the probability of your investments weathering market fluctuations successfully. If the market dips and you’re closer to needing your retirement funds, this means you’ll have less time to recover any money that’s been lost in a market dip.

4. Don’t count on Social Security benefits

In the United States, the increased longevity of a fast-growing, aging population paired with decreased population growth means that more and more people will continue to turn to Social Security benefits. At one point, Social Security will be paying out more benefits than the amount of money that’s coming into the program, which negatively impacts the long-term viability of Social Security.

Many people account for Social Security benefits in their retirement financial planning. Considering how the future of Social Security is increasingly uncertain, people need to account for this possibility by saving more money for retirement earlier on in their careers.

5. Accounting for inflation

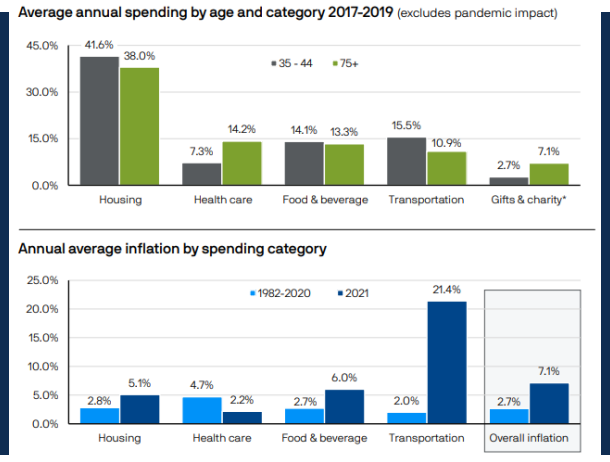

Inflation is a word that we’re hearing a lot recently, and it also impacts your ability to retire comfortably. It’s a reality we all have to live with throughout our lives and take into consideration when planning for retirement. People who start saving for retirement earlier on in their careers increase their chances of their retirement savings being able to keep pace with inflation.

Source: J.P.Morgan Guide to Retirement

Source (top chart): Bureau of Labor Statistics (BLS), 2017-2019 annual average Consumer Expenditure Survey, college educated. 2017–2019 data is used to reflect spending behaviors over the long term; excludes pandemic impact. Additional spending categories for age 35-44 and 75+, respectively: entertainment, 6% and 5%; travel 4% and 4%; other 3% and 4%; apparel 4% and 2%; education 2% and 1%. Source (bottom chart): BLS, Consumer Price Index (all urban consumers, seasonally adjusted), J.P. Morgan Asset Management

6. Longer life expectancies

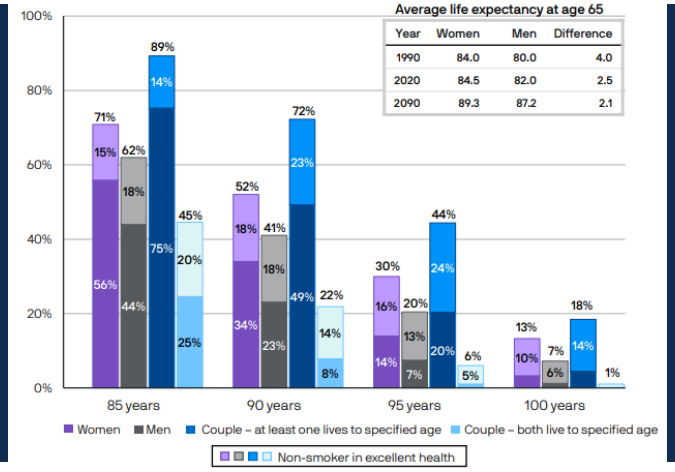

On average, people are living longer than before. Increasing life expectancy means that you’ll likely need more money to retire to be able to care for yourself when you’re no longer able to work.

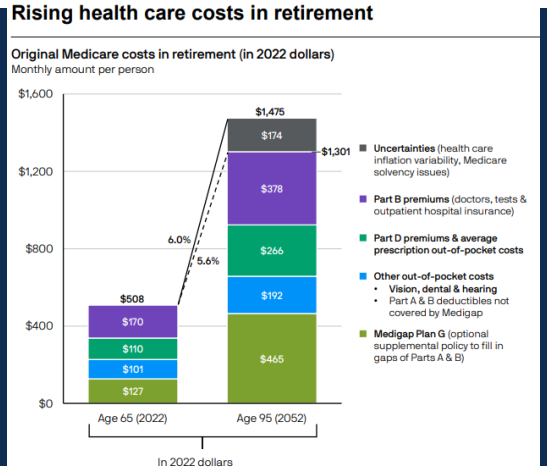

Additionally, as you grow older, it’s also likely that your healthcare costs will increase. Though you have the option of tapping into Medicare benefits, you’ll still need to account for out-of-pocket expenses. With the cost of healthcare increasing year over year, you need to be prepared by getting a head start on your retirement savings.

Life Expectancy Probabilities – If you’re age 65 today, the probability of living to a specific age or beyond:

Source: J.P.Morgan Guide to Retirement

Source (chart): Social Security Administration, Period Life Table, 2018 (published in the 2021 OASDI Trustees Report); American Academy of Actuaries and Society of Actuaries, Actuaries Longevity Illustrator, http://www.longevityillustrator.org/ (accessed January 14, 2022), J.P. Morgan Asset Management. Source (table): Social Security Administration 2021 OASDI Trustees Report. Probability at least one member of a same-sex female couple lives to age 95 is 26% and a same-sex male couple is 14%.

Source: J.P.Morgan Guide to Retirement

Estimated future value total average monthly cost at age 95 is $2,917. Today’s dollar calculation used a 2.3% discount rate to account for overall inflation. Medigap premiums typically increase with age, in addition to inflation, except for the following states: AR, CT, MA, ME, MN, NY, VT, WA. For local information, contact the State Health Insurance Assistance Program (SHIP) https://www.shiptacenter.org/. Plan G premium is nationwide average for non-smokers. If Plan G is not available, analysis includes the most comprehensive plan available. Source: HealthView Services proprietary data file received January 2022 used by permission.

In addition to saving for retirement as early as possible, it’s also important to determine how much you’ll need to save based on the life you want to live when you reach that milestone. To ensure that you’re taking the right steps toward reaching your goals, it’s best to meet with an experienced financial advisor who can help you map out a plan that aligns with current monetary picture and long-term financial goals.

Connect with our retirement team today to learn more about your options.

This material has been prepared for informational purposes only. BRP Group, Inc. and its affiliates, do not provide tax, legal or accounting advice. Please consult with your own tax, legal or accounting professionals before engaging in any transaction.

Securities offered through Kestra Investment Services, Inc. (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS. AHT Retirement Services is not affiliated with Kestra IS or Kestra AS. Neither Kestra IS or its affiliates provide legal or tax advice and are not Certified Public Accounting firms California license #0658748 *not licensed in the states of NY & IL. https://bit.ly/KF-Disclosures

Download the Article

The Early Bird Gets the… Money: 6 Reasons to Start Saving and Investing for Retirement Early