Long-Term Care Insurance (LTCi) is not only a great way to protect income and assets but offers peace of mind by knowing that future burdens on family members are reduced with LTCi protection.

Did you know that LTCi also offers tax advantages as well that make owning LTCi more affordable?

Individuals:

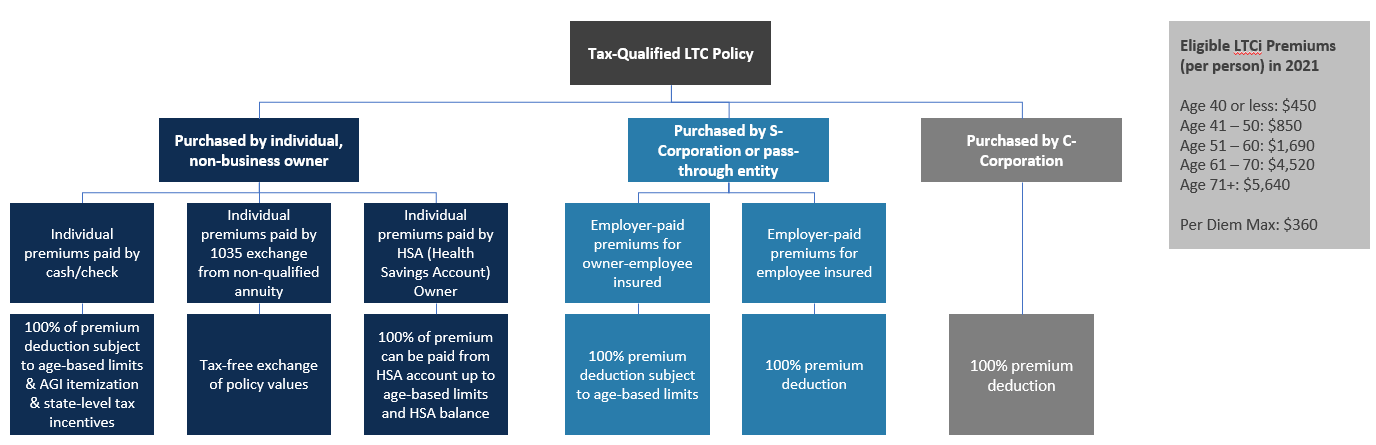

Tax-qualified policies are considered medical expenses. For an individual who itemizes income tax deductions, long-term care insurance premiums are tax deductible to the extent the premiums exceed 10% of an individual’s adjusted gross income (AGI).

The amount of the insurance premium treated as a medical expense is limited to the age-based numbers in the table below.

Not only are tax deductions available to individuals that qualify, but businesses that offer LTCi as a part of their Employee Benefits and pay a portion or all the premiums, can receive tax deductions determined by the tax status of the business; self-employed, C-Corp, LLC, or S-Corp and apply to the spouse/partner, as well.

Health Savings Accounts also offer tax benefits for LTCi. An HSA holds the money in the account, and you get to keep it. The money grows tax deferred. Money taken out of the account is tax-free if used for a health-related expense, and tax-qualified Long-Term Care Insurance premiums qualify as an eligible expense. Any money left in these accounts at age 65 gets converted to an IRA. At that point, the money can be used for anything; however, if used for health-related expenses, including LTC Insurance premiums, the money comes out tax-free.

The IRS has just released 2021 Tax Limits:

| Age at end of 2021 | 2021 Limit | 2020 Limit | 2019 Limit | 2018 Limit |

| 40 or less | $450 | $430 | $420 | $420 |

| 41 – 50 | $850 | $810 | $790 | $780 |

| 51 – 60 | $1,690 | $1,630 | 1,580 | $1,560 |

| 61 – 70 | $4,520 | $4,350 | $4,220 | $4,160 |

| More than 70 | $5,640 | $5,430 | $5,270 | $5,200 |

*Please seek guidance from your CPA or tax advisor.

Tax Incentives for the Self-Employed & Business Owner:

Partnerships, Sub-Chapter S-Corps, & LLCs:

Partners of a Partnership, members of an LLC, or shareholders of greater than 2% of a Subchapter S Corporation are taxed as self-employed individuals. The entity pays the long-term care insurance premium. The partner, member or shareholder includes the premium in its Adjusted Gross Income (AGI) and may deduct the age-based eligible amount on their tax return. It is not necessary to meet the 10% AGI threshold.

C-Corporations can deduct 100% of the premium, and for other types of businesses, the deduction is determined by the above IRS guidelines. It is not subject to age-based limitations.

In all cases, Long-Term Care Insurance is exempt from the Employee Retirement Income Security Act of 1974 (ERISA) rules. This means a business owner does not have to offer this benefit to employees. A business owner can also set up executive carve-outs and provide this benefit for any one person or group of people based on any criteria they decide.

IN CONCLUSION

Long-Term Care Insurance is affordable, protects your assets, offers peace of mind, locks in your health, and allows your loved ones to be companions rather than caregivers.

It is also “nursing-home avoidance” insurance as more people than before want to age in place, especially after COVID-19 exposed the deficiencies in Nursing Homes and Assisted-Living Facilities.

Affordable Long-Term Care Insurance protects your retirement accounts like 401(k)s and IRAs and is fully portable, so no matter where you live, you are protected. But, keep in mind that costs vary geographically.

Noel Evans

Advisor & Long-Term Care Specialist

AHT Insurance

Noel.Evans@ahtins.com

C: 757.409.9065 | O: 202.845.8247