Tackling Higher Commercial Risk & Employee Benefits Premiums

Contain Cost, So Not All is LostUnderstanding the Issue – Global Turmoil Continues to Drive Premiums Upward

GLOBAL TURMOIL CONTINUES TO DRIVE PREMIUMS UPWARD

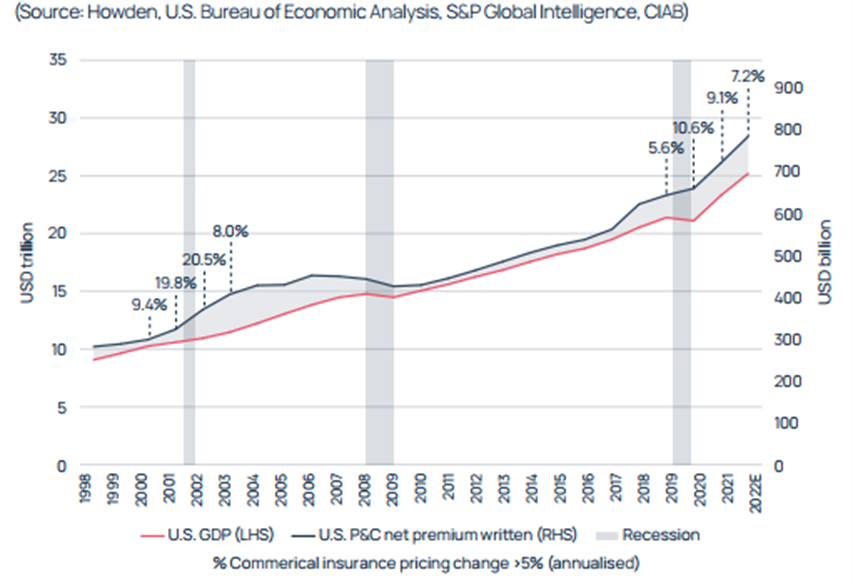

In recent years, global events have been anything but predictable, with instability seeming to be one of the few constants we’ve come to expect. And just as businesses are having to grapple with growing operational costs as a result of these events, so too are insurance carriers. In response to these adverse variables, the property and casualty (P&C) insurance market has hardened, which means premiums are higher, carrier capacity is diminished, and underwriting scrutiny is heightened. Unfortunately, the issues which have led to a hardened insurance market are likely to persist in the foreseeable future.

Why are commercial property insurance prices higher?

Economic pressures such as inflation and the threat of recession all make it difficult for carriers to maintain pricing and keep pace with unpredictable loss patterns. In a high inflationary environment, loss expenses increase, which can result in higher loss ratios for carriers. Furthermore, insurance carriers are as susceptible as all businesses to the threat of a recession, which economic experts fear is on the horizon due to rising interest rates, sustained labor challenges, and reduced economic activity.

Supply chain disruptions brought on by increased demand and slowed production during the COVID-19 pandemic continue and are exacerbated by labor shortages and geopolitical conflict. Supply chain issues have led to a shortage of raw materials – creating construction project delays, driving up rebuilding costs, and increasing losses for carriers.

Persistent labor shortages caused by the Great Resignation and an aging workforce in key industries, including construction, manufacturing, and transportation worsen supply chain issues. Labor shortages in the construction industry means that there are fewer available workers to meet labor demands in regions that experience severe losses due to extreme weather events. To attract and retain talent, employers are raising wages, which is another factor contributing to growing construction costs. Carriers are struggling to adapt risk models to account for growing wages in this sector.

Geopolitical unrest has had far reaching consequences, particularly the Russia-Ukraine conflict. This war has further hampered an already strained supply chain. Additionally, international conflicts also heighten cyber security concerns for businesses and threaten a cyber insurance market with limited capacity.

Extreme and continual loss patterns across property insurance, excess lines, and cyber insurance driven by severe natural disasters, cyber events, and nuclear verdicts pose a threat to carriers that are struggling to adapt underwriting strategies and risk models that better align with volatile exposures. Because past events are no longer indicative of the future, carriers have become cautious in their risk selection and pricing.

Navigating a hardened insurance market

Though finding the right coverage for your business is more challenging than it’s been in years, there are strategies you can implement that safeguard your organization from exposures that can also help you get more favorable market results.

LET'S TAKE A LOOK:

Strategies to Manage the Issue – Optimize Your Coverage to Combat the Tide of Rising Premiums

We’ve said it before, and we’ll say it again: investing in the right insurance for your business isn’t a luxury, it’s a necessity. Insurance is similar to a seat belt. You hope you won’t need to use it, but you’ll be relieved that you have it if you do. Aligning insurance policies with your organization’s operations can offer crucial financial protection that shields your company from unexpected monetary shocks.

But like many things today, the costs of premiums for many lines of coverage have continually increased in recent years, leading business owners to wonder how they can get the coverage they need at the best price possible.

Meeting the challenges of balancing cost of coverage with your company’s needs requires optimization. Insurance optimization is the process of determining the most efficient way to spend money while getting an appropriate level of protection for an organization and its employees.

Here are some steps you can take to ensure that you’re optimizing your insurance coverage.

Find a trustworthy broker partner

Partnering with a reputable, experienced broker can significantly alleviate the burden of finding policies that match your business needs. Your broker should provide recommendations about how to optimize your insurance coverage by learning how your business operates and determining the risks it faces. They should clearly communicate what you stand to lose in dollars should you not invest in safety and loss prevention programs and a properly structured insurance program. Ask them questions that will demonstrate their experience with similar clients. Working with the right broker is step one to achieving optimal coverage.

Understand what your risks are

Risks can be anything from an exploitable vulnerability in your IT systems to a failure to provide a safe work environment for your employees, both of which can result in financial losses. The goal is to ensure decision makers and board members understand how a loss impacts the company’s finances, so they buy into the value of insurance and invest in a culture of safety. When optimizing an insurance program, your broker can help prioritize risks based on the likelihood of occurrence and the financial impact they would have on your company.

Determine the coverages for your business needs

Mapping your business risks will give you a good idea of which lines of coverage you’ll need and the premiums and deductibles needed for them – along with guidance from your trusted broker. Some types of insurance will be required by law, while others will be good to have based on how your business operates.

Invest in safety and loss prevention to minimize exposure to risks

Knowing your risks should also help you see how to prioritize funds on safety and loss prevention. You’re probably familiar with the saying, “an ounce of prevention is worth a pound of cure.” This is a philosophy you should apply when it comes to your company’s risks. Taking these measures is likely to result in savings from prevented incidents in the long run, as well as premium savings because carriers look favorably at companies who take precautions to avoid losses.

Paint a picture of your risk profile that carriers will understand

Underwriters are more likely to provide favorable terms for coverage if they have a clear picture of your risks. Your broker should know the ins and outs of your business, as well as use data and analytics, to effectively represent your company to carriers – helping to make your entity a more favorable risk.

Regularly evaluate your policies

As your business changes, so do its liabilities, which is why you should evaluate your policies at least once a year. If your operations grew or shrank or you purchased new equipment, this impacts the coverage you’ll need to protect your business. Regularly communicate with your broker about changes to your business and how this affects your coverage so your insurance program is optimized to your evolving needs.

Although none of us like to have to pay more for the things that we need, periods of time that are economically challenging serve as an opportunity for businesses to dial into process improvements that result in cost savings. With many lines of coverage increasing in price, your organization has the power to take measures that can lead to optimized coverage outcomes so that your business is financially protected during these times of economic uncertainty. Aligning yourself with the right broker will be critical to help get the outcomes you want from your insurance.

Determining a Path Forward – Weathering the Storm of Future Economic Turbulence

With economic growth slowing and inflation soaring, businesses both large and small are feeling the effects of economic uncertainty while bracing themselves for a potential recession. Additionally, labor issues, the supply chain crisis, and geopolitical conflicts are all variables which have conflated to test organizations’ ability to remain productive and profitable. Businesses are now looking for ways to help weather the storm.

Fortunately, there are steps you can take to help safeguard your balance sheet from economic instability. Business leaders can use this as an opportunity to take proactive steps to optimize their cash flow management and improve their liquidity.

Here are some quick reminders about how you can be better financially prepared during periods of economic downturn:

Organize

Maintain accurate financial statements and review them regularly so that you always have full visibility into the financial state of your business. Staying abreast of your company’s finances makes it easier to make preventive changes if your cash flow is moving in a negative direction.

Model scenarios to test your resilience

Forecasting your cash flow before you experience issues can allow you to prevent situations that could put you in a bind, and to create contingency plans for worst case scenarios. Will you have large bills to pay before you receive payment for services you’ve rendered and limited cash on hand to fall back on? Being organized, as mentioned above, can help you see potential future financial traps.

Stay on top of billing and invoicing

Analyze your customer base and know who has a history of paying early or late, as well as who might be in danger of going out of business. The speed with which customers pay you has a direct impact on your cash flow and liquidity. Issue invoices as soon as possible, clearly communicate your terms for payment, and implement penalties for late payments to encourage customers to pay on time. Also, provide as many payment options as possible (check, credit card, ACH, Wire) that include ease of use, but also contemplate any fees that may be incurred for any of these products.

Review all vendor agreements

Now is the time to look at your contractual obligations to ensure that the terms of your agreements are still competitive. If you have good relationships with your vendors, you might even be able to renegotiate the terms of your agreements to free up cash.

DID YOU KNOW? If you work with outside vendors, it’s a valuable risk mitigation practice to include cyber insurance in their contract as a requirement to do business with your company. Outside vendors you regularly work with or that have access to any of your systems, can put you at risk if they experience or cause a cyberattack. A secondary benefit is that in the event of a significant cyber event, a cyber liability policy can help avoid your vendor going insolvent as a result.

Invest in growth, carefully

In times when you expect sales to slow, reevaluate how you’re spending money on projects and their strategic impact. Buy less inventory and freeze unnecessary spending to protect your liquidity.

Look for ways to reduce costs

Now is the time to find areas in your business where you might be able to reduce costs. Assess business units, identify areas that are underperforming, and restructure to minimize costs as needed – optimizing your supply chain, making adjustments to your production, and more.

DID YOU KNOW? Adequately structured insurance coverages and limits can offer significant financial protection in the wake of a triggering event, making insurance one of the best investments you can make for your business.

Use data and technology to your advantage

You should take advantage of technology enabled solutions to streamline business processes and increase efficiency. Additionally, using data in tandem with digital tools empowers you to more reliably forecast profit and loss, build better models and forecasts, and identify blind spots where you might be wasting money.

DID YOU KNOW? When it comes to risk management, using technology for insurance benchmarking analysis can help you set up goals, identify areas for improvement, lower insurance costs, and prevent future claims.

Optimize your insurance coverage

Regularly communicate with your broker partner to ensure that you have the right amount of coverage for your business risks. You don’t want to find yourself in a position where you’re financially liable for an event that could have been covered by insurance, but you also don’t want to spend extra money on lines of coverage or limits that you might not need. Always stay abreast of the risks your business faces and what this amounts to in dollars.

Though persistent, unfavorable economic conditions and the threat of a recession are understandably worrisome, they also create an opportunity for you to make positive changes to the way your business operates and manages its finances. A good starting point is to connect with your broker partner to evaluate how you can build a risk management strategy and put the most appropriate insurance policies in place that help safeguard your company from a crisis.

Contact us for assistance navigating coverage options that can help your business withstand the unexpected.

This material has been prepared for informational purposes only. BRP Group, Inc. and its affiliates, do not provide tax, legal or accounting advice. Please consult with your own tax, legal or accounting professionals before engaging in any transaction.